Table of Contents

Spicejet

SpiceJet has allotted 104,172,634 equity shares to nine Ireland-based aviation companies, representing a 6.86% stake in the airline’s expanded equity share capital.

The shares were issued at ₹42.32 per share, raising approximately ₹442 crore (US $50 million).

This move reduces SpiceJet’s liabilities by ₹442 crore and provides access to US $79.60 million in cash maintenance reserves and US $9.90 million in lease obligation credits.

The airline’s post-allotment share capital increased to 1,517,693,901 shares. SpiceJet’s Chairman, Ajay Singh, views this as a significant step in the company’s restructuring efforts.

Bulk Deals Block Deals Insider Trades (Oct 2025)

5Paisa Capital

Shubhi Consultancy Services LLP has acquired a 7.46% stake in 5Paisa Capital Ltd through open market purchases.

The acquisition involved 23,31,000 equity shares, conducted between November 17-19, 2025.

This move has increased Shubhi Consultancy Services LLP’s total holding, including persons acting in concert, to 8.00% of the company’s voting rights.

The significant change in shareholding structure could potentially influence 5Paisa Capital’s decision-making processes and strategic direction.

Kotak Mahindra Bank

Kotak Bank experienced significant block trades on the National Stock Exchange.

The first deal involved 3,269,498 shares at Rs. 2,099.60 per share, totaling Rs. 686.46 crores.

A second trade of 254,463 shares at Rs. 2,093.30 per share amounted to Rs. 53.27 crores.

These large volume trades, typically associated with institutional investors, may influence market sentiment and potentially impact the stock price.

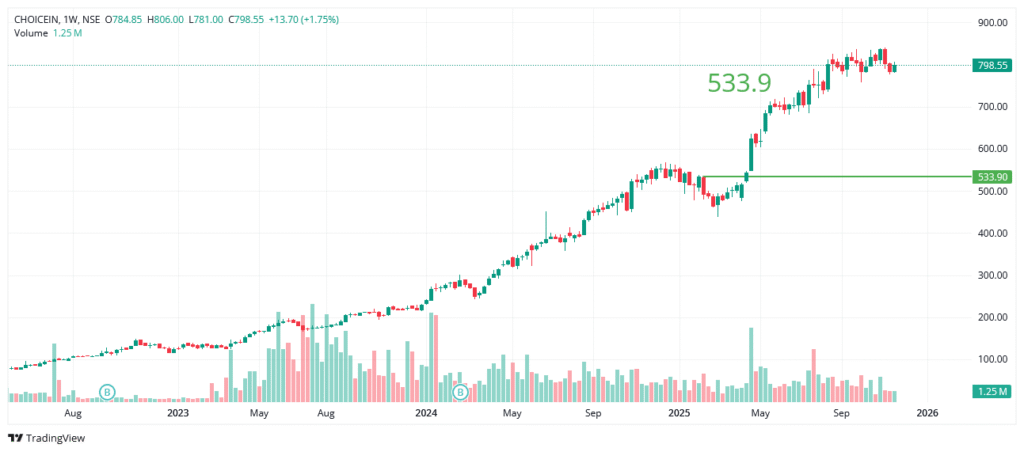

Choice International

Choice Consultancy Services Private Limited (CCSPL), a subsidiary of Choice International, has acquired a 100% stake in Ayoleeza Consultants Private Limited.

Ayoleeza brings expertise in Railways & Metros, Roads & Highways, Bridges, Tunnels, and Urban Infrastructure, with live orders exceeding ₹200 Crores.

The acquisition strengthens Choice International’s position in infrastructure advisory and aligns with its vision to expand its Public Sector Consulting vertical.

Ayoleeza’s team of 200+ professionals and two decades of experience are expected to enhance CCSPL’s capabilities in large-scale infrastructure projects across India.

Tilaknagar Industries

Saraswati Commercial (India) Limited, an NBFC, has acquired 7,00,000 equity shares (0.27% stake) in Tilaknagar Industries Limited for Rs. 26.74 crores.

The investment was made through convertible warrant conversion at Rs. 382 per share.

The transaction exceeds the disclosure threshold under SEBI regulations.

Tilaknagar Industries has a net worth of Rs. 882.25 crores and an annual turnover of Rs. 3,174.61 crores.

TV Today Network

Living Media India Limited has increased its controlling stake in TV Today Network Limited through a block deal on the stock exchange.

The company acquired 23,86,745 equity shares, representing a 4% stake, at the prevailing market price.

This transaction has raised Living Media India’s total shareholding in TV Today Network from 56.90% to 60.90%, further solidifying its position as the majority shareholder.

KEC International

KEC International witnessed a substantial block trade on NSE, involving 1,343,486 shares at Rs. 708.45 per share, totaling Rs. 95.18 crores.

The company recently clarified its relationship with PGCIL, stating that PGCIL’s recent communication doesn’t affect existing project execution.

KEC’s year-to-date order intake exceeds Rs. 17,000 crores, with a current unexecuted order book of Rs. 39,325 crores.

The company maintains a positive outlook with a tender pipeline over Rs. 1,80,000 crores and an L1 position exceeding Rs. 4,000 crores.

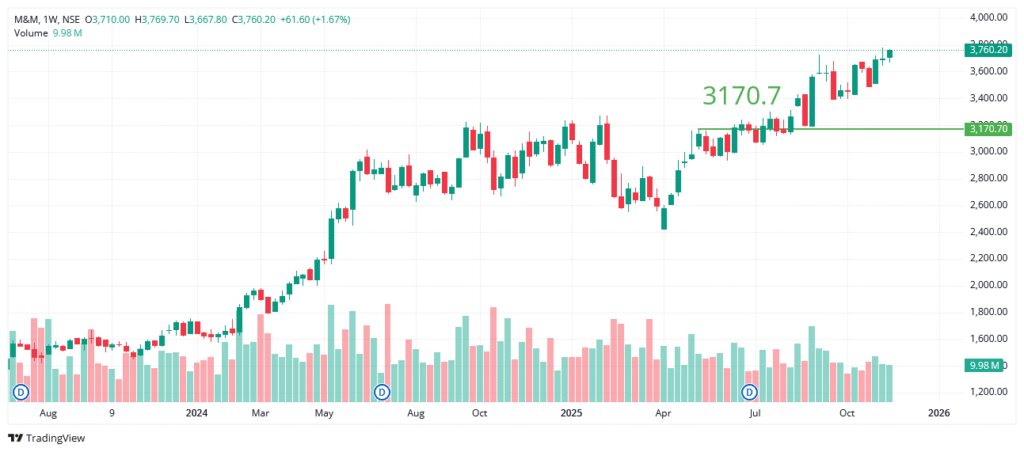

Mahindra & Mahindra

Mahindra & Mahindra witnessed a significant block trade on the National Stock Exchange involving 236,407 shares.

The transaction was valued at Rs. 88.61 crores, with shares priced at Rs. 3,748.30 each.

This block deal indicates substantial institutional or bulk investor activity in M&M’s stock.

The company is scheduled to hold a Mahindra Group Investor Day in Mumbai, as per their recent LODR filing.

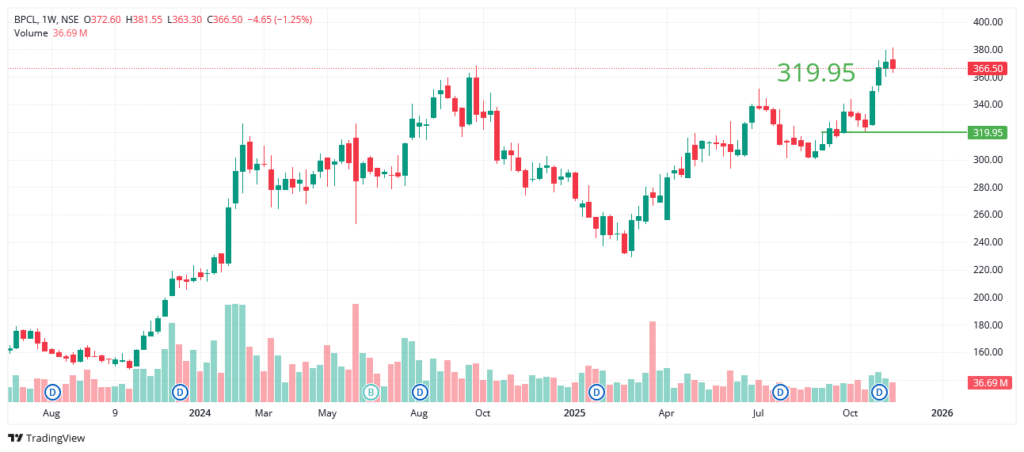

Bharat Petroleum

Life Insurance Corporation of India (LIC) has significantly reduced its shareholding in Bharat Petroleum Corporation Ltd (BPCL) from 8.758% to 6.757%.

LIC sold 86,772,543 shares through market sale between June 21, 2024, and November 18, 2025.

The transaction was reported in compliance with SEBI regulations.

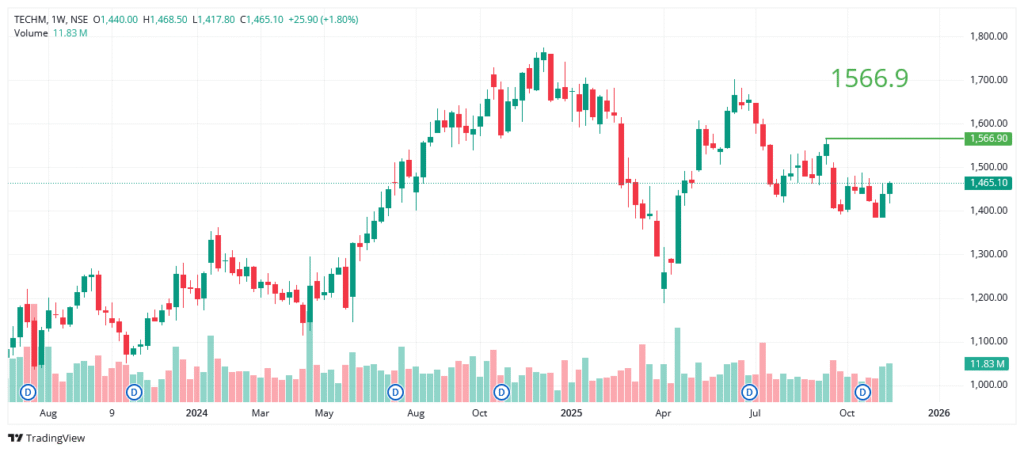

Tech Mahindra

Tech Mahindra experienced a significant block trade on the National Stock Exchange (NSE).

The transaction involved 2,335,071 shares traded at Rs. 1,433.10 per share, totaling Rs. 334.64 crores.

This large-volume trade suggests substantial institutional or bulk investor activity in Tech Mahindra’s stock.

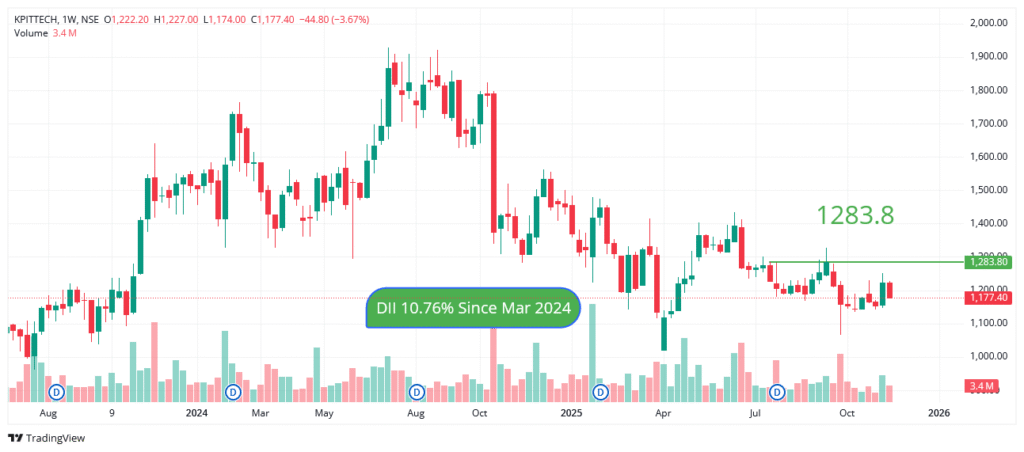

KPIT Technologies

KPIT Technologies has made significant progress in acquiring Caresoft, strengthening its position in automotive software.

The total consideration was renegotiated to $157 million, including a $15 million variable component.

KPIT has paid $97 million so far, acquiring entities in the USA, UK, Mexico, and Italy.

The company made strategic investments of €28 million and $28 million into its UK and USA subsidiaries respectively to facilitate the acquisition.

Suprajit Engineering

Suprajit Engineering, a leading automotive component manufacturer, has made a strategic investment of €1 million in Blubrake, an Italian company specializing in advanced braking systems.

This investment aims to expand Suprajit‘s technological capabilities and market presence in the automotive safety sector.

Blubrake is known for its innovative anti-lock braking systems for e-bikes and light electric vehicles.

The partnership is expected to create synergies in technology transfer, market expansion, and product development, potentially opening new avenues for Suprajit in the evolving automotive industry, particularly in the e-mobility sector.

Azad Engineering

Azad Engineering Limited has entered into a Master Terms Agreement with Pratt & Whitney Canada Corp. for the development and manufacturing of aircraft engine components.

This long-term international collaboration aims to enhance Azad’s manufacturing capabilities in the aerospace industry.

While specific financial details and execution timeframes are undisclosed due to confidentiality, the partnership aligns with national strategic priorities and could potentially strengthen Azad’s position in the global aerospace sector.

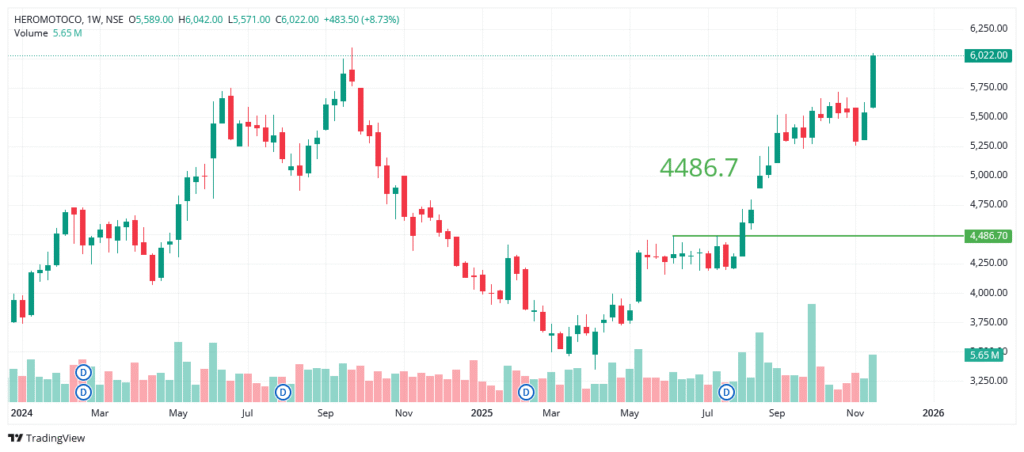

Hero MotoCorp

A significant block trade of 93,053 Hero MotoCorp shares, valued at Rs. 54.06 crores, was executed on the NSE at Rs. 5,810.00 per share.

The company has also announced a Non-Deal Road Show for investors on November 20, 2025, in Mumbai.

The investor meeting announcement was signed by Vikram Kasbekar, Executive Director & Acting CEO of Hero MotoCorp.