Vijay Kedia Portfolio, Vaibhav Global Q2 FY 26 Results

Vaibhav Global Limited, a Vijay Kedia portfolio stock and a prominent player in the global E-tailing sector, has reported robust financial results for the second quarter of the fiscal year 2026, showcasing a significant growth trajectory.

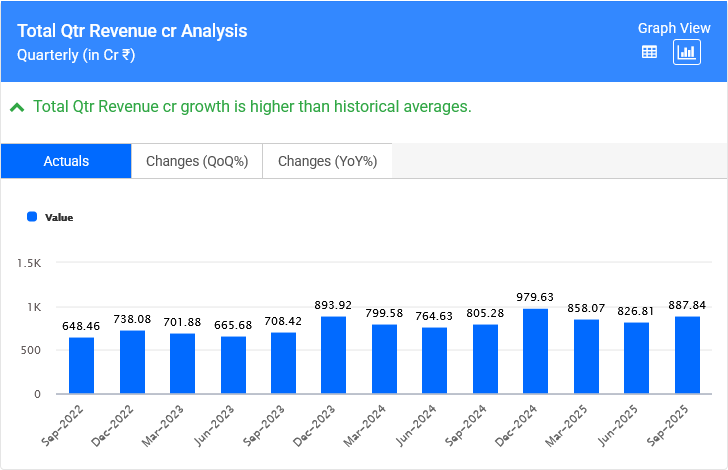

The company’s revenue surged by 10.2% year-on-year, reaching ₹877 crores, surpassing its own guidance, according to an exchange filing.

Vaibhav Global Revenue For Q2 FY 26 (Vijay Kedia Portfolio

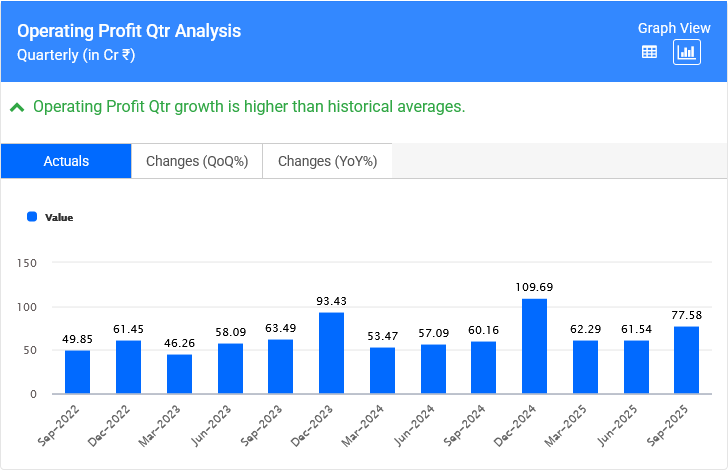

Vaibhav Global Operating Profit For Q2 FY 26 (Vijay Kedia Portfolio)

This growth is attributed to a strategic focus on an efficient product mix and disciplined pricing, which also led to an impressive 63.5% gross margin.

The company’s EBITDA saw a substantial increase of 28% year-on-year, with margins expanding by 130 basis points to 10%. This improvement was driven by productivity gains and operating leverage, as noted in the press release.

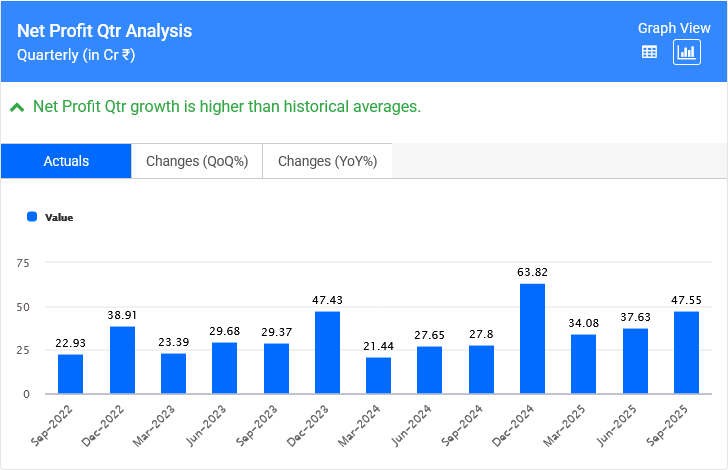

Vaibhav Global Net Profit For Q2 FY 26

The Profit After Tax (PAT) for the quarter stood at ₹47.55 crores, marking a remarkable 71% increase from the previous year.

VGL’s balance sheet remains robust, with a net cash position of ₹156 crores, reflecting the company’s strong financial health.

The return on capital employed (ROCE) was reported at 20%, while the return on equity (ROE) was at 13%, indicating efficient use of capital and shareholder equity.

The digital revenue mix accounted for 42% of the B2C revenue, highlighting the company’s successful digital transformation efforts.

The company’s in-house brands contributed 41% of the gross B2C revenue, up from 31% in the same quarter of the previous fiscal year.

The company also reported an all-time high of 7.14 lakh unique customers on a trailing twelve-month basis, a 5% increase year-on-year, with 3.8 lakh new customer acquisitions during the same period.