FII DII Data, FII Data

From Rs. 120 to Rs. 891 in Dec 2024, the stock gave a multibagger returns of 600% in 4 years.

Shares of this multibagger stock touched 1202 in Sept 2024 . It retraced to its current levels.

The stock name is PNB HOUSING FINANCE LTD

PNB Housing Finance Ltd has witnessed huge buying interest from FIIs & DIIs.

FIIs have added 2.53% stake in the company.

DIIs (Mutual Funds) have added a 11.22% in the company.

Although the stock has given a multibagger return in last 4 years, it is still down by approximately 37% from its all time high levels.

Company’s PE_EPS chart looks interesting too.

About PNB Housing Finance LTD

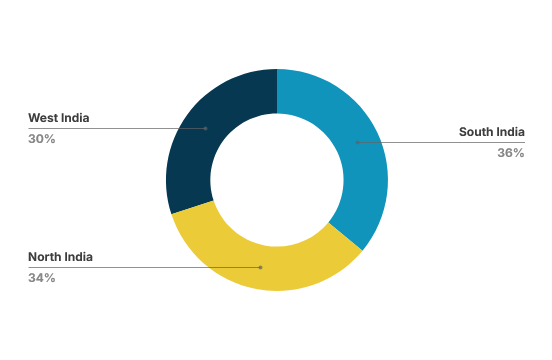

PNB Housing Finance Limited specializes in providing loans for housing and commercial spaces, as well as loan against property and purchase of residential plots.

The company operates through a branch network for sales, processing hubs for support functions, and an enterprise system solution for integrating activities and enhancing operational efficiencies.

By focusing on delivering quality services to customers, PNB Housing Finance Limited aims to meet the diverse financing needs of individuals and corporate entities. Read less.

Market Position

The company is the third-largest HFC in India with a reported outstanding AUM of Rs. ~71,200 Cr as of FY24 vs Rs. 66,900 Cr in FY22.

It is also the third-largest HFC by loan book, and largest player by deposits. Total loan book stood at Rs. 65,300 Cr in FY24 vs Rs. 57,800 Cr in FY22. Total deposits stood at Rs. 17,700 Cr in FY24.

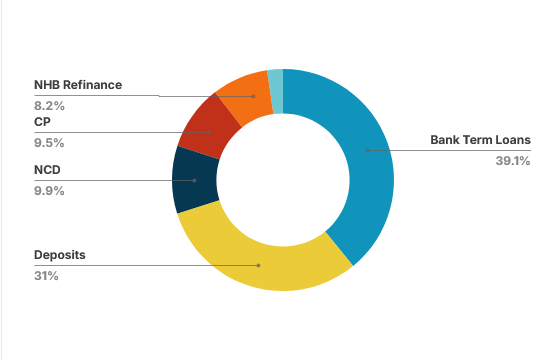

Borrowings

In FY24, total borrowings stood at Rs. ~55,000 Cr vs Rs. ~53,000 Cr in FY22 and the cost of borrowings stood at 7.93%

Growth Table

Network

As of FY24, the company has a network of 300 branches (vs 137 branches in FY22) and 14,000+ active channel partners for loans and deposits.